Feeling overwhelmed by your finances? You’re not alone. In today’s complex world, juggling current accounts, credit cards, savings goals, and the ever-present temptation of another subscription service can feel like a full-time job. For years, we’ve turned to budgeting apps for help. They connect to our accounts, show us where our money is going, and help us track our spending. But is that enough?

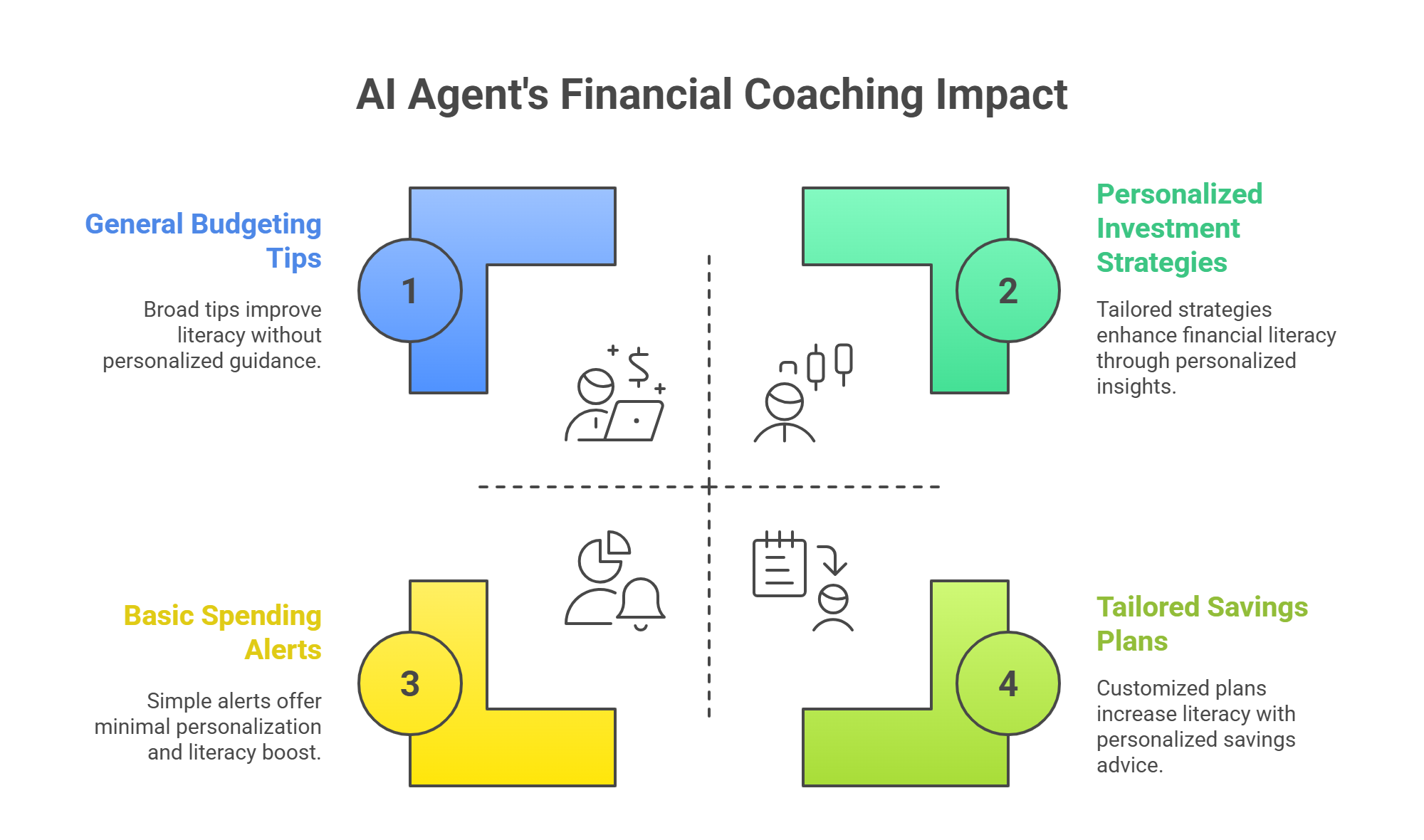

While these apps are great at showing you a snapshot of your financial past, they often fall short of providing genuine, forward-looking guidance. The most powerful features—the ones that feel like having a real expert on your side—are frequently locked behind expensive subscription tiers. This leaves many of us with pretty charts but no clear path forward.

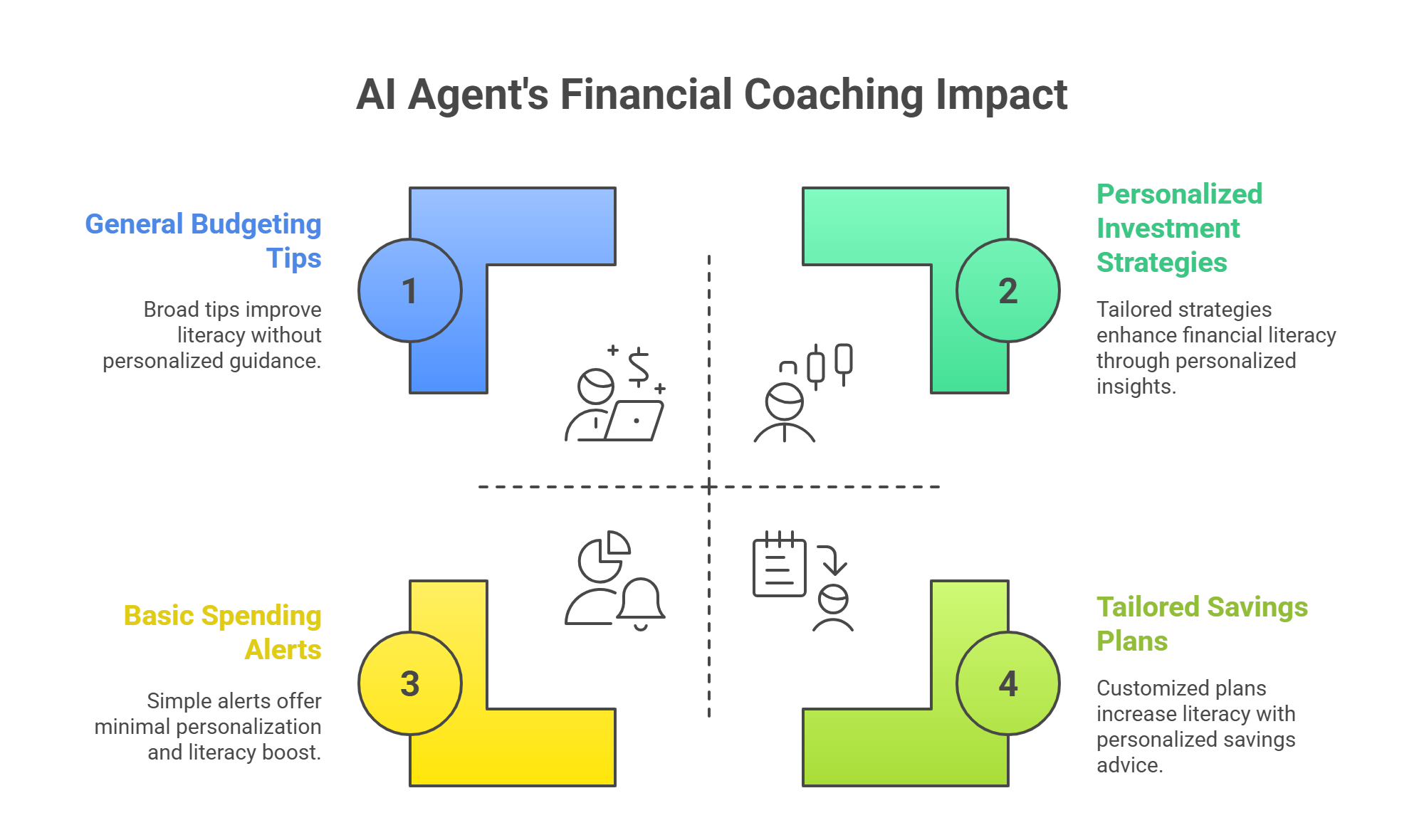

But what if there was a better way? What if your financial app didn’t just report on your spending but actively coached you to improve it? A new generation of technology is emerging, powered by artificial intelligence, that promises to do just that. This isn’t just another budgeting tool; it’s an AI Financial Coach, an intelligent pocket advisor designed to provide personalised, proactive, and conversational guidance to help you achieve true financial wellness.

The Problem with Our Current Money Apps

The UK’s financial technology scene has exploded thanks to Open Banking, a regulation that allows you to securely share your financial data with authorized apps. This has given rise to a fantastic ecosystem of tools. You’ve likely heard of the big players:

- Aggregators like Emma give you a brilliant single view of all your accounts.

- Money-savers like Snoop proactively find ways for you to cut costs.

- Automated savers like Plum cleverly squirrel away money without you even noticing.

- Digital banks like Monzo and Revolut have integrated many of these features directly into their banking apps.

These services are incredibly useful, but they highlight two key challenges for the average user.

1. The Value Bottleneck 💰

Many of these apps operate on a “freemium” model. You get basic tracking and insights for free, which is great. However, the truly transformative features, like AI-driven coaching or advanced analytics, are often reserved for premium plans that can cost up to £15 per month. This creates a two-tiered system where most users get a passive dashboard, while only a paying minority gets access to genuine, AI-powered guidance. You get the what, but you have to pay a premium for the so what? and the what’s next?.

2. A Fragmented Experience 🧩

The second issue is fragmentation. You might use one app to track your subscriptions, another to automate your savings, and your banking app for basic budgeting. While each is good at its specific job, no single app effectively guides you through the entire financial wellness journey.

Imagine this: an app flags that you’ve overspent on takeaways. What happens next? In a fragmented system, nothing. You just feel a bit guilty. A truly integrated coach, however, would connect the dots. It would identify the overspend, suggest a specific budget tweak for next month, automatically transfer the saved money towards a goal you’ve set (like a holiday), and maybe even offer some educational tips on how to invest those savings once you hit your target. This cohesive “coaching narrative” is the missing link in today’s market.

How an AI Financial Coach Actually Works

So, what makes an AI financial coach different? It’s not just about algorithms; it’s about creating a seamless journey from data to dialogue. It’s designed to be your trusted financial companion, transforming complex data into simple, actionable conversations.

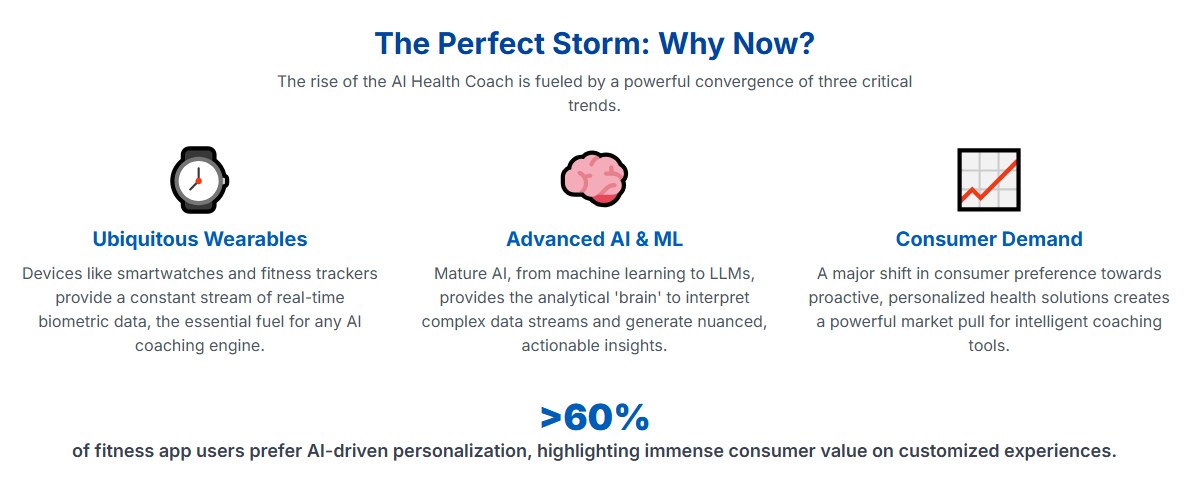

Step 1: Securely Connecting the Dots (Aggregation)

The journey begins with Open Banking. Using a highly secure, regulated interface from a provider like Plaid or Yodlee, you grant the app read-only access to your financial accounts. This is a critical point on security: the app never sees or stores your bank login details. You are redirected to your own bank’s secure portal to approve the connection. The app receives a secure token that grants access, which you can revoke at any time. This allows the AI to get a complete, 360-degree view of your finances—current accounts, credit cards, savings, and even loans—to build a full picture.

Step 2: Finding the Story in Your Spending (Intelligence)

Once connected, the AI gets to work. This is where machine learning (ML) comes in.

- Automated Categorisation: The AI reads the often-cryptic transaction descriptions (e.g., “TFL.GOV/CP TRAVEL CHARGE”) and, using advanced text-understanding models, accurately categorises it as ‘Transport’. Good categorisation is the foundation of everything that follows.

- Pattern Recognition: The system then analyses your categorised spending over time to find patterns. It can identify all your recurring subscriptions, flag unusually high spending in a category, and analyse your cash flow to find the perfect, painless amount to automatically save.

- Predictive Budgeting: Instead of just applying a generic 50/30/20 rule, the AI analyses your personal income and spending history to create a realistic, personalised budget that anticipates your regular bills and adapts to your life.

Step 3: Turning Insights into a Conversation (Coaching)

This is the real game-changer. All the data-driven insights are delivered not through a boring dashboard, but through a friendly, conversational chat interface. This is powered by Natural Language Generation (NLG), a technology that translates raw data into human-like text.

Instead of just showing a graph indicating you’re over budget on “Dining Out,” the AI coach might say:

“Hey, I noticed spending on takeaways was a bit higher than usual this month. If we can bring that back in line with your goal next month, you’ll be right on track to afford that weekend trip you’re saving for! Shall we look at a plan?”

This empathetic, non-judgmental approach transforms data points into a supportive narrative. It provides encouragement, fosters good habits, and makes managing your money feel less like a chore and more like a collaborative journey.

The Pillars of Trust: Security, Regulation, and Transparency

Handing over financial data requires immense trust. Any credible AI financial coach must be built on an unshakeable foundation of security, regulatory compliance, and ethical principles.

Security and Privacy by Design

Beyond the secure Open Banking connection, the entire system must be built with a security-first mindset. This means adhering to UK GDPR rules, ensuring all your data is encrypted both when stored and when being transmitted, and using multi-factor authentication to protect your account. The principle of Data Minimisation is key: the app should only collect the data that is absolutely necessary to provide its coaching service.

Navigating the Regulatory Minefield: Guidance vs. Advice

The UK’s Financial Conduct Authority (FCA) draws a very clear line between “guidance” and “advice.”

- Guidance is impartial information that helps you understand your options (e.g., explaining what an ISA is). This is not a regulated activity.

- Advice is a personal recommendation to buy a specific product (e.g., “you should invest in this specific fund”). This is a highly regulated activity requiring full authorisation.

A true AI coach must operate firmly in the “guidance” space. It can act as an Investment Education Hub, providing clear, factual information about different types of investments or government schemes. However, it must always be accompanied by clear disclaimers stating, “This is not financial advice,” empowering you with knowledge while ensuring the final decision is always yours.

The “Why?” Button: The Power of Explainable AI (XAI)

One of the biggest barriers to trusting AI is the “black box” problem—when it makes a decision, but you have no idea why. Explainable AI (XAI) is the solution.

Imagine the AI suggests reducing your ‘Entertainment’ budget. A trustworthy coach would include a “Why?” button. Tapping it would reveal a simple explanation:

“We’re suggesting this because your spending in this category has increased by 30% over the last three months, and it’s the area where a small change will have the biggest impact on reaching your ‘New Car’ savings goal by December.”

This transparency is vital. It demystifies the technology and transforms the AI from an opaque, dictatorial tool into a transparent, trustworthy partner. It empowers you by explaining its reasoning, making it far more likely that you will understand, accept, and act on its guidance.

The Future is Holistic: Open Finance

The journey doesn’t stop here. The market is slowly moving from Open Banking to Open Finance. This will expand data sharing to include your entire financial world: pensions, insurance, mortgages, and investments.

As this happens, your AI financial coach will become even more powerful. With a truly holistic view of your financial life, it can provide hyper-personalised coaching on everything from your mortgage rate to your pension performance, solidifying its role as the single, indispensable advisor for your entire financial well-being. The intelligent pocket advisor is no longer a futuristic concept; it’s the next logical step in our relationship with money.